...a tool that helps you TRACK and CONTROL your business...

Learn more tokenomics

Watch video version of this article

Click to subscribe:

When you look up "What is a blockchain?" the top search results commonly describe it as a:

...decentralised, distributed, digital ledger...

Unfortunately... for most people this definition does not go very far towards explaining things.

It just substitutes one technical term for several more...!

And yet, the reason why this definition has risen to the top of search lists is because conceptualising blockchains as a ledger technology can be very helpful to understand the benefits that they can deliver to private business and public economic activity.

So let's begin unpacking this 'decentralised distributed digital ledger' term piece by piece, to build up to an understanding of what it all means... and - more importantly - why we should care!

We start off by asking "What is a Digital Ledger?"

A brief history of 'the ledger'

'Getting blockchain technology' often requires you to appreciate how it allows us to reinvent and expand upon tools and services that we are already familiar with today. But to make that extra stretch in your comprehension, you need to be super clear about what those familiar tools are really doing for us in the first place.

So... to understand the significance of blockchains as 'ledgers'... we need to go back to closely examine the properties and functions of old-school ledgers first!

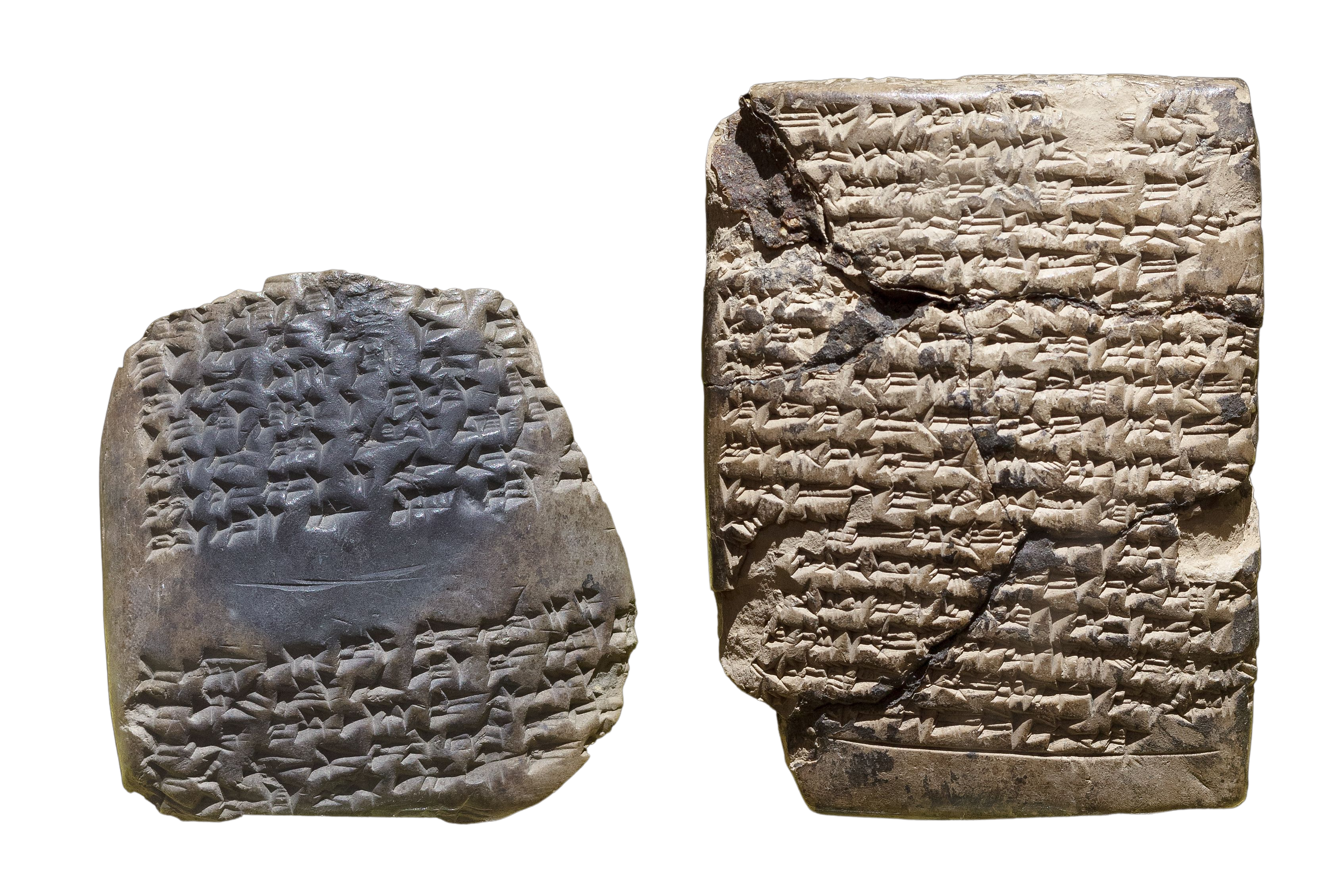

Take a look at the image below:

Clay tablets like these date back to around 3,000 BCE and were created by the inhabitants of the Sumerian civilization of ancient Mesopotamia. Often, the inscriptions concern accounts of resources used in economic life. Indeed some scholars believe that it was a system of accounting that preceded and helped to drive the invention of writing.

Evidently, ledgers been so vital to supporting complex economic life, that they've been around for MILLENNIA.

These earliest ledgers were simply used to record transactions.

A "transaction" is defined as:

...a completed exchange of countable resources...

The 'exchange' in question in its simplest form takes place between two individuals, but we can extend this notion to include exchanges between any distinct economic agents, including groups of individuals, and differing divisions within a single business.

The value of such simple ledger use is clear. They serve as a record-keeping device about business events.

This allows us to:

- Keep track of past events

- Plan better for the future

- Keep track of outstanding commitments

Once we rely on such ledgers to keep economic records, it's a small extra step to use this information to modify our economic actions according to its contents. This tells us that:

ledgers can be used as passive records, AND as active controls of our business activities

Let's illustrate this with two examples.

First consider the illustration in the slide below. A transaction of physical resources takes place (beetroots for physical cash), and a matching entry is created in the ledger which counts the number of units of resources exchanged.

In this application, the ledger is a passive record and there is no necessary link between what happens in the ledger and the action that has occurred.

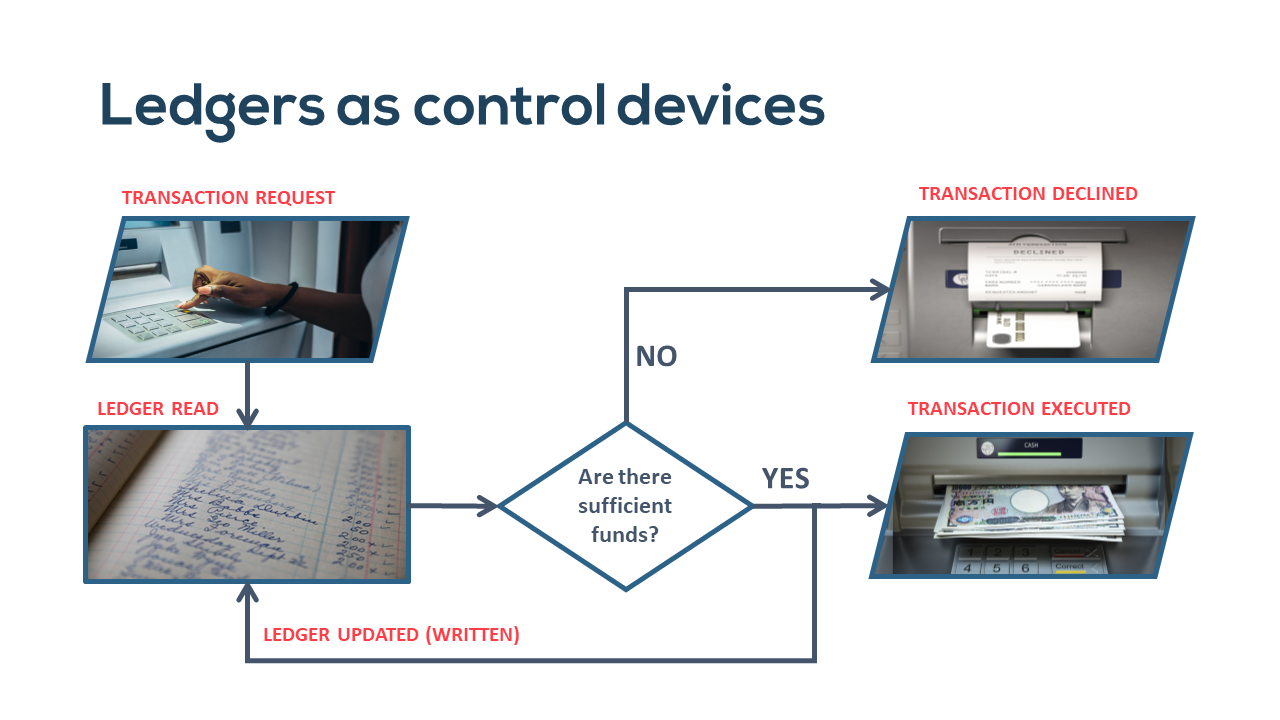

Now consider the case of an ATM cash withdrawal.

As the illustration below shows, the transaction event and ledger entry although still physically separate, are NOT independent events.

The sequence of actions shown begins with a user making a cash withdrawal request, a ledger is then read from, to check whether the user has funds credited to their account, and accepts or declines the transaction based on the ledger data.

Crucially, if the transaction is approved, the ledger is updated (or written to) to add in the details of this latest transaction, so that future control actions take this event into account.

Now even though this ATM example makes use of a digital ledger, that detail is incidental to this example Banks used ledgers were used to control their activities long before the digital revolution. Which invites us to ask:

What are the benefits of ledgers 'going digital'?

The 'digital' advantage

Digitising our ledgers can create dramatic economic gains in THREE ways, on account of how the upgrade changes their:

- Capacity

- Scope

- Fidelity

1. Capacity

Digitisation VASTLY improves ledgers' fundamental capacities for tracking and control:

- Read, write, and decision actions happen at the speed of light

- Control rules become programmable

- More complex logic can be developed and automated

- Control execution is more reliable and repeatable

This creates new opportunities for eliminating many labour costs and losses due to human error, and can make complex business processes less costly to deploy and scale.

In short, we will get to do a lot more, with a lot less...

2. Scope

Going digital also radically increases the scope of ledger applications.

Just in virtue of being digital... their ability to track and control our economic activity extends into "digital space" itself. They can support rich, complex chains of economic activity that unfold entirely inside of digital systems before settling out into tangible, physical-world consequences.

This digital scope is of growing importance as more of our economic activity becomes digitally mediated, and as we ourselves become more comfortable and more deeply immersed in digitally mediated experiences.

3. Fidelity

There's one more special sort of efficiency that digital ledgers unlock when they are used manage processes that are entirely digital.

In these applications, we may not require there to be a separation between the ledger and the things for which it accounts. The ledger can do it all! And in these applications economic actions and the data they record are the same thing.

This is a significant departure from our physical intuitions of how ledgers work.

This new integrated design removes a key "point-of-failure" from the traditional ledger — one that allows for the possibility of data becoming misaligned with the events it is intended to record.

If economic actions and their data are fundamentally integrated, such misalignments are no longer possible. This creates opportunities for improved economic efficiency and data quality all at once.

If you follow this idea through... it comes with some surprising implications...

Yes!

In a certain sense... there aren't any Bitcoins...!

They don't exist as separate "Bitcoin stuff" to be counted. The Bitcoin blockchain is a singular and complete document for determining who has what, and how they can use it.

Any actions that people take are completely identified with changes recorded to the blockchain and nothing can tease those "two things" apart.

Summary and recap

We set out to learn 'what is a digital ledger', on our journey to learn why blockchains are described as decentralised, distributed, digital ledgers.

Ledgers have been around in one guise or another for thousands of years, because they help us with the fundamental task of tracking and controlling our economic actions.

The digital upgrade grants our ledgers:

- Greater capabilities for tracking and control

- A greater scope for digital application

- A stronger link between actions and facts - which can now be made indivisible

These benefits present considerable prospects for our economic conduct and management. And yet, they do not fully cover the benefits that blockchain technology is poised to offer us... by virtue of being — not merely a "digital ledger"— but one that is also distributed and decentralised. So...

Next time...

... we'll continue with our journey and learn what "distributed ledger" means!

Roderick is a blockchain professional, specialising in tokenomics advisory and economic design.

His advisory contributions have helped raise over $100m for blockchain startups, and he brings over 10 years of prior quantitative modelling, financial analysis, and transaction experience to his work.

He resources the innovative thinking needed for this emerging field with strong academic foundations that include a MSc. in Economic Policy from UCL, and the CFA Charter.

Roderick is inspired by the potential he sees for blockchain technology to address old, long-standing economic issues that many students are still being taught are impossible be solve.

A life-long learner, he eagerly participates in knowledge building by sharing his expertise through open blog and video content, and by offering specialised training courses to help aspiring professionals start out and advance in this field.