Learn more tokenomics

Watch video version of this article

Click to subscribe:

The structure of a typical token sale is comprised of three general parts:

- Token supply — a determinate number of tokens in existence

- Allocations — a partition of supply designated to different uses and actors

- Vesting — a schedule that releases allocation tokens over time

The typical way to continue this post, would be to reel off a set of "first do this, then do that" style instructions.

That sort of stuff you can find all over the internet — I don't want to waste your time repeating it here.

Telling you WHAT is done... leaves you in no position to understand WHY it's done that way... or WHY it matters.

That's the deeper perspective I would like to share with you today. That's what will help you think intelligently about this topic, instead of just parroting along with the rest of the flock.

This is important because the structure of token sales deserve careful attention.

They are not a fad or flash in the pan. In a sector that is defined by constant unrelenting change, the core structure used for token sales today remains unchanged since it started being used in 2017.

It's sticking around. And is likely to remain the basis of any token fundraise formats that succeed it.

So, today we're going to learn how we structure a token sale... while paying closer attention to the underlying economic logic and technical features that support it, and which enable it to work as a fundraising format.

Great, so let's start at the beginning...

In order to structure a token sale... you need to have some tokens to sell first!

So it's time to have a chat about the 'birds and the bees' and ask...

Where do tokens come from?

It all starts with a glint in the lead developer's eye! The powers of creation ultimately sit in their hands.

Logically, there are two distinct ways they can bring tokens into existence:

- Define a RULE that creates tokens over time

- Set a number of tokens to exist from the very beginning

The contemporary token sale structure typically builds from the second approach.

That format allows developers to define a SPECIFIC number of tokens to be created upfront, which are set aside exclusively to be sold for startup capital.

Since these rules are handled by smart contracts deployed on the host blockchain, these rules are transparent, auditable and will reliably execute as they are coded.

That gives investors strong reassurance that the quantity of tokens they have agreed to buy exist from the moment the token's smart contract goes live, and that these tokens will be sent to the blockchain wallet address they have instructed in their token sale agreement.

This act of token creation on the blockchain is known as the token generation event, usually abbreviated as "TGE".

Within the industry, this supply of tokens created at TGE is variously referred to as:

- The token supply

- The initial token supply

If the supply design means the number of tokens in existence (or those that are usable) changes over time - The maximum supply

In the opposite case, to stress that the number of tokens available/usable is permanently fixed (per the current smart contract) - The genesis supply

A reference to the creation story in the Christian Bible which was introduced by Bitcoin, which described the first block of its blockchain as the "Genesis Block" - The pre-mined supply

Another reference to Bitcoin. It did not create a large initial supply of tokens at TGE, and created new Bitcoin over time, block by block, to be claimed by the "miners" who solve the cryptographic puzzles that add security to its network. Since TGE minting creates tokens upfront and independently of any mining-like process, those tokens are sometimes referred to as a "pre-mined" supply

So to sum that up, developers use the TGE to create the tokens that are sold to investors in exchange for startup capital.

And so that accounts for the first component of our general token sale structure: the token supply.

But imagine for a second that you're sitting in the developer's seat. You've just used your god-like powers to create tokens, and have leveraged them to raise startup capital... Surely, you'd ask yourself...

Why stop there...?

You could create more tokens and put them to other uses...

That's the function the 'allocations' achieve in a typical token sale structure.

Developers use the TGE to create additional token allocations to support other financial and economic needs, in addition to fundraising.

These uses can be highly diverse and project specific. They may be used by project-aligned agents and protocols to further the ends of the project in some way, or to compensate or incentivise non-aligned agents.

Pause to think about this for a moment...

It represents a dramatic departure from conventional corporate finance.

A TGE-funded token sale (together with the exchange listing that typically follows it) allows a project to capitalise themselves with two economic assets at once!

But perhaps you think that this is not unique, after all...

Doesn't equity do the same...?

Like tokens, equity shares can be created "out of thin-air". And once a company sells some shares of its stock in exchange for an investment, that values the rest of the shares that remain unsold..., and that gives some bearing on the company's ability to raise additional financing by selling more stock.

This is superficially correct...

But it also misses TWO important differences that make the self-capitalisation that happens in the token case dramatically different:

-

Tokens are often financially liquid early in the project's life (equity isn't)

So long as liquidity is available, tokens are usable as liquid financial assets that are able to cover expenses and fund other exceptional transactions. -

Most tokens are designed as 'utility tokens'

If we take that choice in good faith (not just as a means of escaping securities regulation), it means these tokens are working assets in their economies. (Unlike equity — Tesla does not use equity to build its cars!)

This implies that a TGE-funded project has the means to self-capitalise its "working capital" base (and the regulating institutions of its token economy), without having to increase its fiat fundraising burden.

These two differences make tokens financially and economic effective in ways that early-stage equity can't be.

The double capitalisation that you get with a TGE-funded token sale is much more economically significant than with an equity financing. TGE-funded projects ARE meaningfully capitalising themselves with "two assets at once".

Does this mean that a project gets to fund anything it wants...?

The "invisible" tax

NO.

Bringing tokens into existence with a few keystrokes is easy... But attracting the value that backs them — whether through good will; speculative interest; redeemable claims; or utility — is NOT so easy.

And without sufficient value-backing, the entry of all these tokens into circulating supply — which are freely tradeable on exchanges — ends up being inflationary.

High rates of inflation:

- Erodes tokens' ability to generate financial returns for early token sale investors

- Erodes tokens' effectiveness as incentive instruments within their economies

But no one said all those tokens had to flood into the economy all at once...

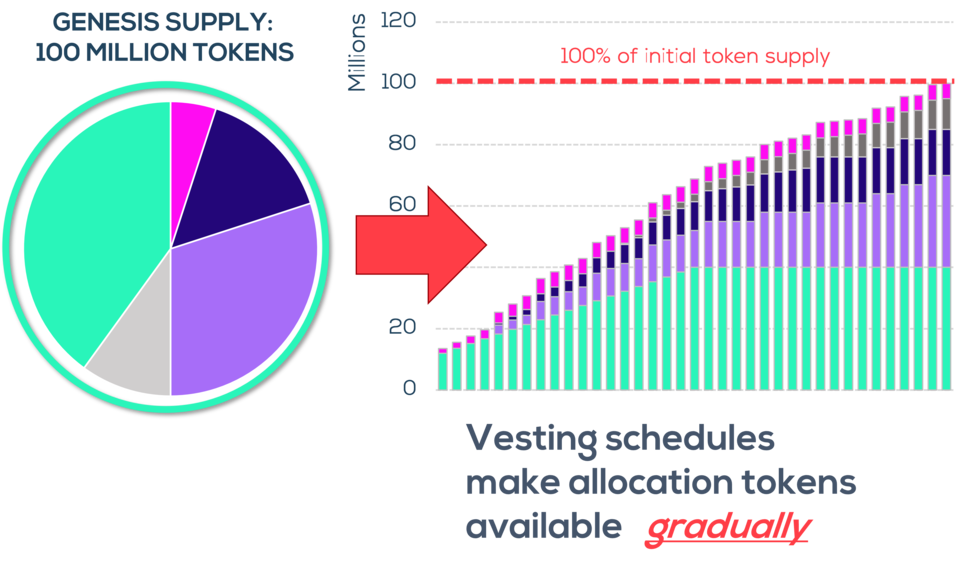

What if the tokens were released into the economy gradually?

That's a key purpose of what the vesting schedules in a typical token sale structure are designed to do.

Notice that this is very different to how vesting is used in the equity world to award bonus worker compensation. In that context, vesting is principally used as an incentive alignment mechanism.

But in a token sale context, we often use vesting schedules as instruments of token 'monetary policy'.

Although, it's also important to note that in practice... vesting schedules are very crude and limited monetary instruments:

- Vesting only controls when tokens first become available to enter into circulation — not when agent actions actually do so

- Predicting and matching the rate of underlying value growth, and judging the right time to distribute value to agents who aren't making ongoing economic contributions (like investors) is impossible to get right up front

Myself and other fellow tokenomics professionals believe these difficulties merit a revision to the standard vesting format. But for the time being, the standard, time-determined vesting schedules are still what is being expected from token investors. And as providers of the capital that gets startups going, that means they continue to call the shots for now...

Summary and recap

We started off by explaining that the structure of a token sale has three parts:

- Token supply

- Allocations

- Vesting

The underlying explanations behind each part of this structure, respectively, are that projects:

- Self-finance by creating tokens that exist as soon as the smart contract goes live

- Allocate these tokens to different, specific uses

- Regulate the rate at which these tokens are usable by these actors

We saw that this form of self-capitalisation has the potential to be much more economically consequential than in equity financing, owing to the token's early liquidity, and typical role as a working asset.

All the same, there are still constraints in play.

Minting too many tokens; giving them to the wrong players; making them available too soon; or (heaven forbid) all three!; can destroy a token's value standing through inflation.

Fortunately, the transparency and auditability of blockchain smart contracts allows investors to scrutinise token sale and distribution terms, and gain assurance that the token distribution plan will be faithfully and securely executed.

If you want to LEARN MORE about the details of how they evaluate the offer and make their decision I dive into all those details in my tokenomics training course.

Next time...

... I'll share a warning with you about one of the biggest mistakes that founders and developers make with the immense powers that this token sale structure gives them!

Weighing it all up

So now that we understand the parts of a token sale offer and their economic function... how do we make sense of making out whether they are good or bad?

[complex topic check out my own course...]

mention smart contracts and trust...??

But what we can say here... in non-technical terms, a good token sale offer needs to give a reasonable answer to a reasonable question about these new tokens:

A rough guide to a good response, is that it should offer a strong case to explain that:

"Who gets what? When? And Why?"

So

So yes, developers can use their powers to achieve much more than has previously been possible through an early-stage equity financing... But they CAN'T stretch those powers out without limit!

The short answer is that WE do...!

"We"... as prospective investors and users of the token in the sale proposal.

The rules that govern the token's economic attributes are defined and executed on immutable smart contracts deployed on a public blockchain.

These contracts are fully transparent and auditable, and the offer truthful statements about the smart contract's code will execute.

This means we can check the contract to decide for ourselves whether the numbers "add up"...!

And many times they won't.

The guide for a good response, is that it should make a strong case that:

- Tokens are distributed to agents who have contributed value to the economic process that the token supports

- The increase in supply arising from the tokens they are granted does not outstrip or disrupt the ability of the token economy to continue driving a sustainable flow of value

Roderick is a blockchain professional, specialising in tokenomics advisory and economic design.

His advisory contributions have helped raise over $100m for blockchain startups, and he brings over 10 years of prior quantitative modelling, financial analysis, and transaction experience to his work.

He resources the innovative thinking needed for this emerging field with strong academic foundations that include a MSc. in Economic Policy from UCL, and the CFA Charter.

Roderick is inspired by the potential he sees for blockchain technology to address old, long-standing economic issues that many students are still being taught are impossible be solve.

A life-long learner, he eagerly participates in knowledge building by sharing his expertise through open blog and video content, and by offering specialised training courses to help aspiring professionals start out and advance in this field.