Strengthen your FINANCIAL understanding of tokenomics, and help your project raise capital!

Tokenomics is highly-interdisciplinary, but when it comes to token sales and initial listings, the view from traditional finance is critical. This course will teach you how investors think, how to make them attractive offers they find attractive, how to adjust offers during negotiations, and how to set budgets that help your project last.

-

You will get...

- SIX hours of video teaching content with English subtitles

- TEN interactive quizzes to build your understanding

- PRINTABLE learning materials to accompany videos

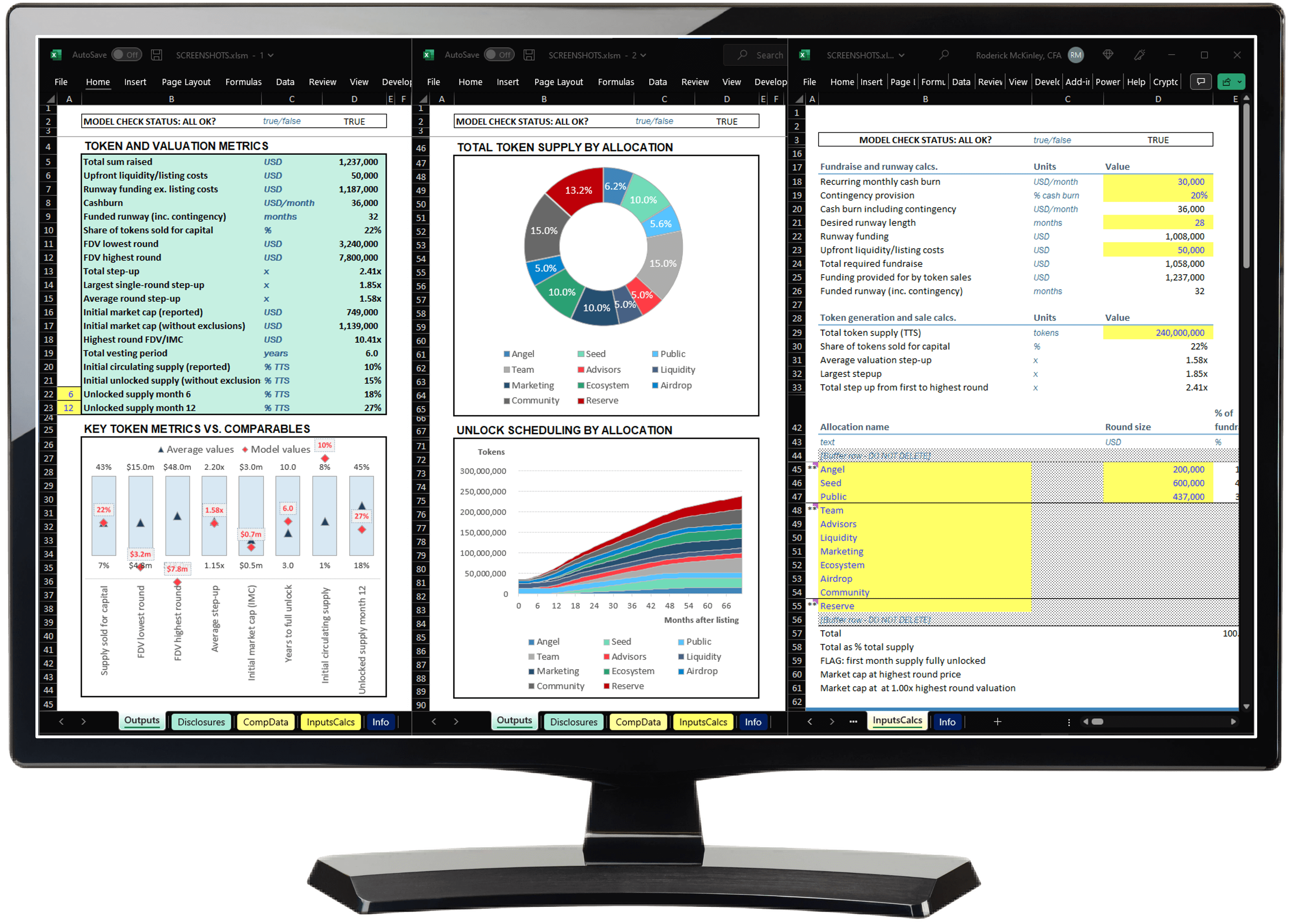

- TOKENOMICS MODEL in Excel and Google Sheets formats

- SEVEN in-depth exercises focused on real-world scenarios

- TOP-TIER instructor with real blockchain and finance expertise

About your instructor

Roderick McKinley, CFA

- Real blockchain experience including over $100m raised with token sales

- Proven professional training experience with over 13,000 online course sales

- Advanced modelling skills applied to $1bn+ deals approved by 'Big 4' auditors

- Top academic and professional credentials including masters degree studies in economics and CFA Charter

What past students say and where they work...

-

Excellent course - especially code walkthrough videos!

Ivan Khazheev

-

Concise and straight to key points. Follows industry practices.

Terry Shan

-

Very well explained, and great model. Just the advanced level I was looking for.

Hector Reyes Flores

-

Excellent course! A lot of insight, for beginners or for experienced professionals.

I learned a lot of new tricks and found the exercises very useful as well.

Tanel Joon

-

VERY HELPFUL!

Considers a lot of scenarios and provides a great model template.

Karen Liang

-

Very good course, deep and practical.

Teacher has good skills and has good ability to communicate.

Pedro Sanz

-

GREAT

Yacouba

-

Great course.

Clear and concise teaching with extremely practical applications.

Luis

-

Very well structured, visually good and with good explanations.

It's not easy to find a course like this in the market!

Getulio Magalhaes

-

Gave me much more self-confidence in my modelling.

It's hard to find courses with the details needed to progress to more difficult levels.

Lauria Lopes Protasio

Risk-free purchase guarantee

Your purchase is fully refundable for the

first 14 days for you to learn and explore!

Course content

Introduction and overview

- + What will I learn? (click to preview)

- + Who is this course for? (click to preview)

- + What is in this course? (click to preview)

- + What prior knowledge to I need? (click to preview)

- + Who will be teaching me? (click to preview)

- + Learning materials download and support info

Token fundraising and listing fundamentals

- + How do token sales raise capital?

- + How are tokens created?

- + Who gets these tokens? What do they want?

- + Vesting: why the big picture matters

- + Why cash is always KING!

- + Multi-round fundraise strategy

- + Non-investor token allocations

- + How are tokens listed?

- + Should you fundraise with equity or tokens?

Token sale modelling fundamentals

- + What makes a good model?

- + What is in the model? (click to preview)

- + What is NOT in the model?

Model deep dive

- + Introduction and overview

- + Inputs and controls

- + Automatic safety checks

- + Understanding the calculations

Token metrics

- + Introducing the token metrics (click to preview)

- + Total token supply

- + Total vesting term

- + Intitial circulating supply and initial market cap

- + Fully diluted valuation (FDV)

- + Extra token metrics!

- + Metrics in context: comparable transaction analysis

Practical model exercises

- + Preview of all exercises (click to preview)

- + Building an offer from scratch

- + Fixing bad client tokenomics

- + Converting equity into tokens

- + Increasing the fundraise

- + Helping a struggling fundraise

- + Ending a fundraise early

- + Making final adjustments before the listing

What's next...???

- + ???