Web3 Is a Business. Let's Treat It That Way.

Data-led insights. TradFi discipline. Delivered.

Solutions that Web3 Deserves

Onchain Analytics

and Smart Contract Decoding

- Extract real-time and historical insights from your smart contract interactions

- Build custom Python pipelines to decode and structure blockchain data

- Design tailored metrics and dashboards in Dune, PowerBI or custom frontends

Token Economics

and Financial Modeling

- Design utilities and incentives that align with stakeholders and financial goals

- Leverage your real-world operations data for richer analysis and forecasting

- Simulate future financial outcomes with flexible, readable, assumption-driven models

Data-Led Risk Insights

and Scenario Analysis

- Apply data-driven methods to surface financial and operational risk signals

- Use scenario modeling to explore edge cases and build for resilience

- Bring a structured, FRM-informed approach to risk analysis in tokenized systems

Token Sale Offer

and Listing Advisory

- Set token pricing, and vesting that resonate with today’s market

- Support negotiations with investors, market makers and exchanges

- Craft high-converting marketing collateral for decks and whitepapers

Business Tokenization

Planning and Development

- Identify which parts of your business benefit most from tokenization

- Align token models with stakeholder incentives and business goals

- Design token mechanics that reinforce sustainability and utility

Financial Planning

and Treasury Management

- Build and stress-test budgets to extend your runway with confidence

- Optimize treasury allocation strategies for digital asset operations

- Monitor performance and risks with tailored financial analytics

Flexible Tool Choices

Best Fit Solutions

Cursor AI

Python

SQL

Dune

Power BI

Excel

VBA

Flexible Tool Choices

Best Fit Solutions

Cursor AI

Python

SQL

Dune

Power BI

Excel

VBA

Proof of Work

Proof of Skill

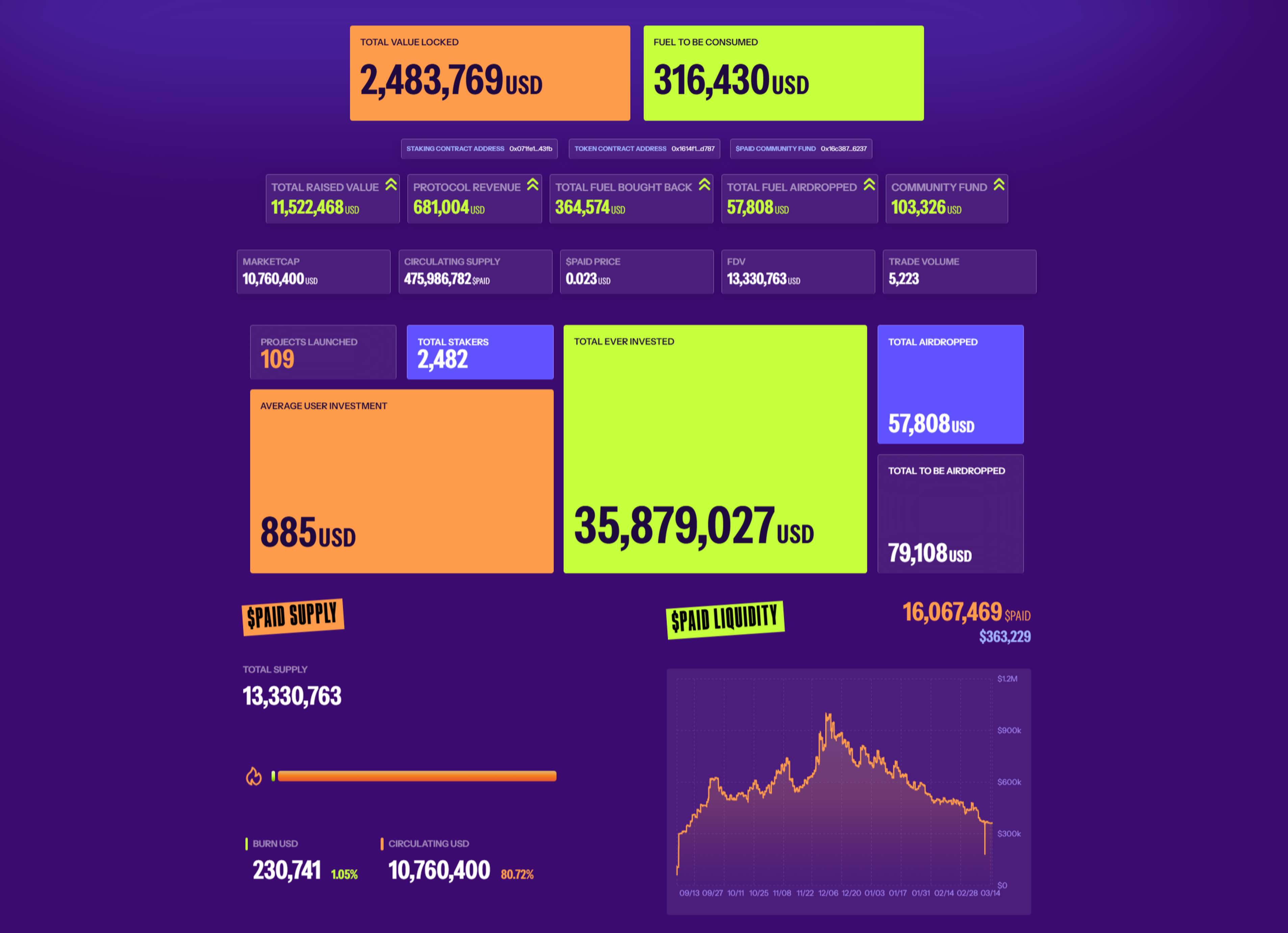

Token Economy Onchain Analytics

- Engineered a public-facing token dashboard with Python

- Pulled data from 5 EVM chains + CoinGecko API

- Integrated internal data from MongoDB

- Containerized ETL pipeline using Docker

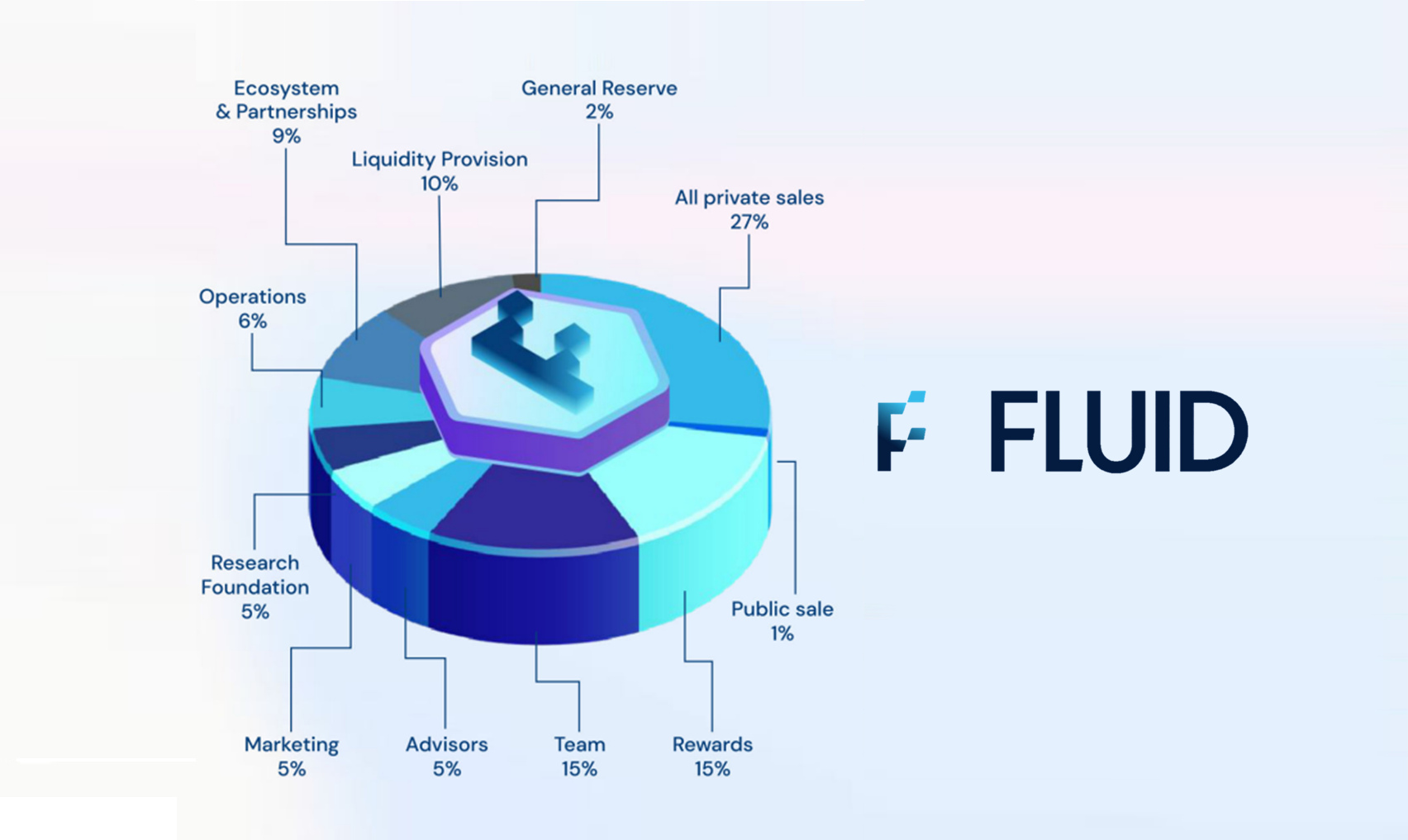

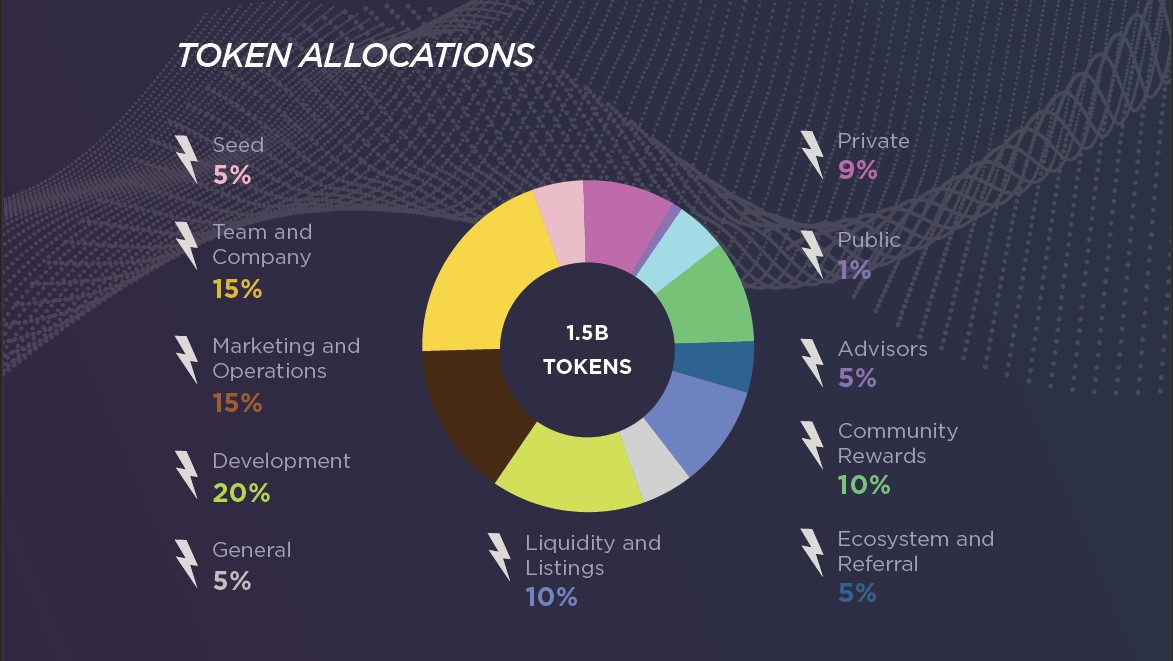

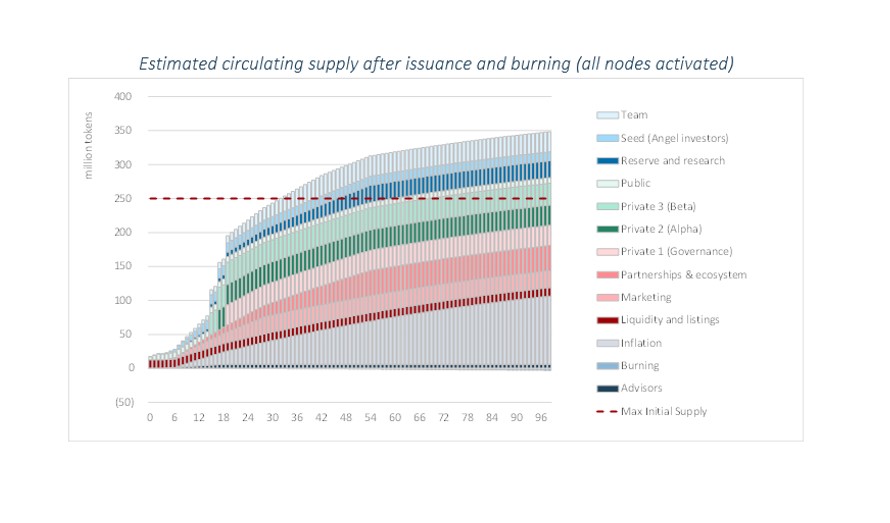

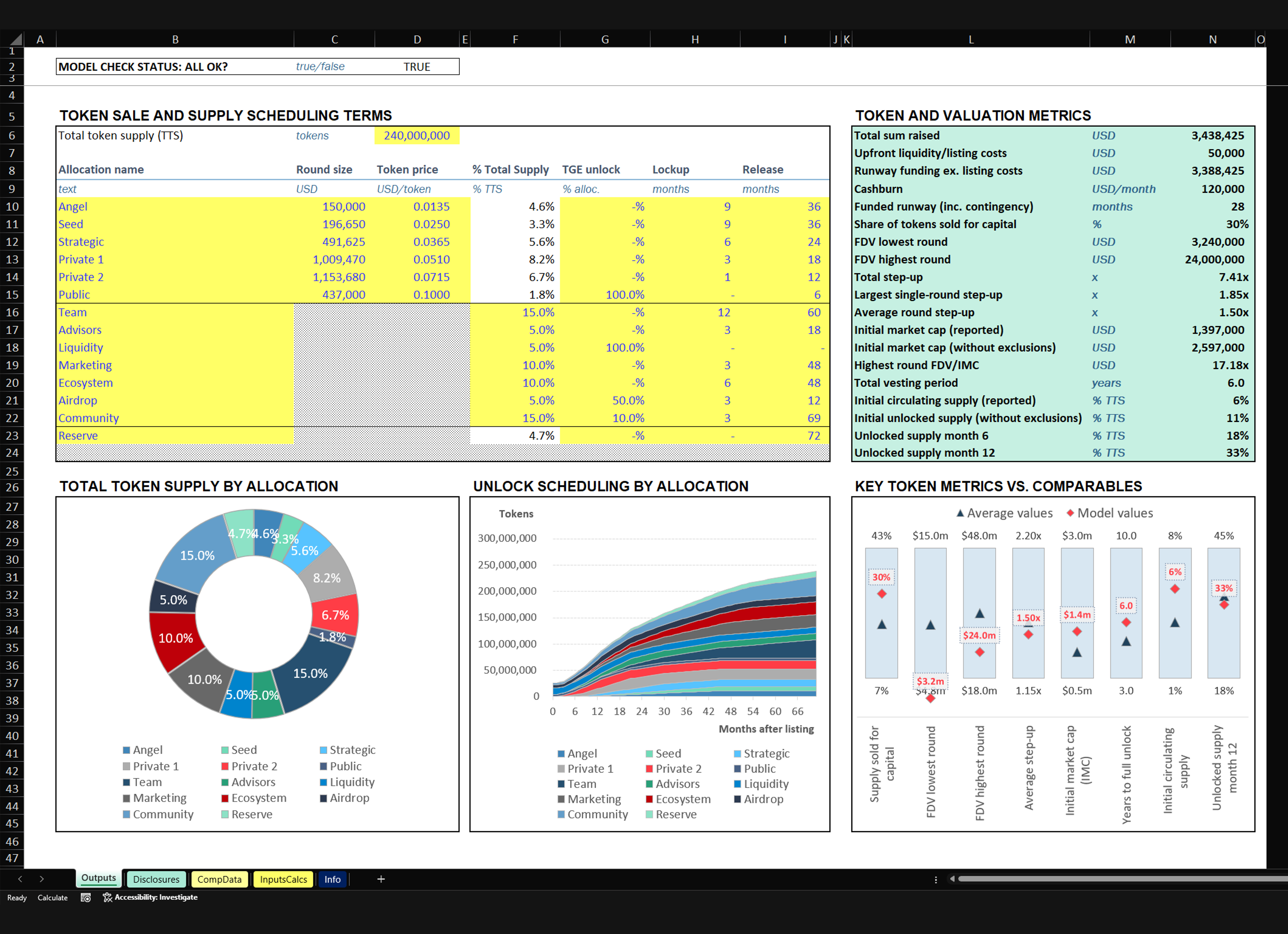

Token Sale and Distribution Tool

- Rich, flexible, transparent tool for structuring token sales

- Follows TradFi 'comps' approach to create credible investor offer

- Used in internal planning and fundraising

- Ready to plug into broader budgeting and financial planning models

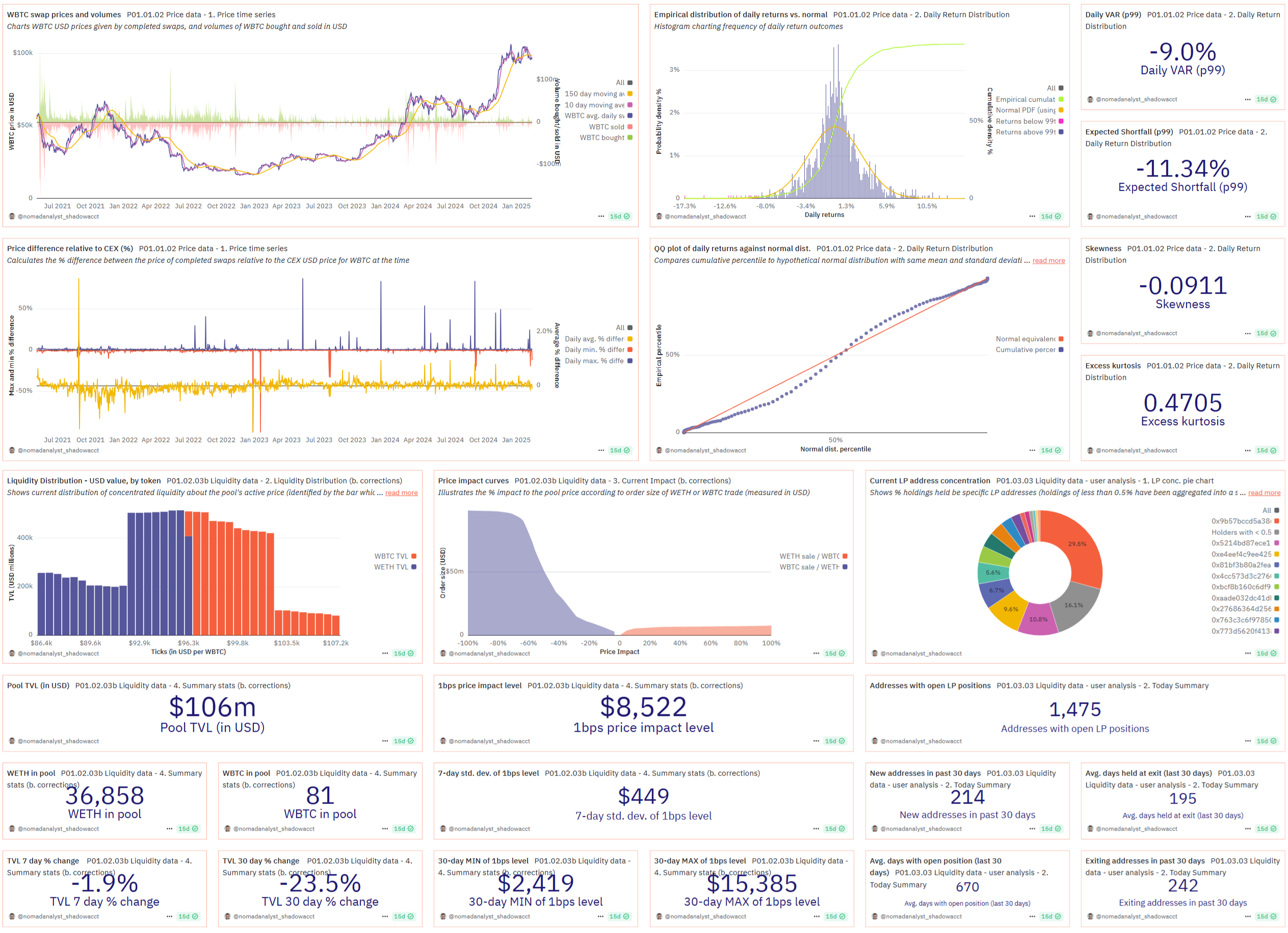

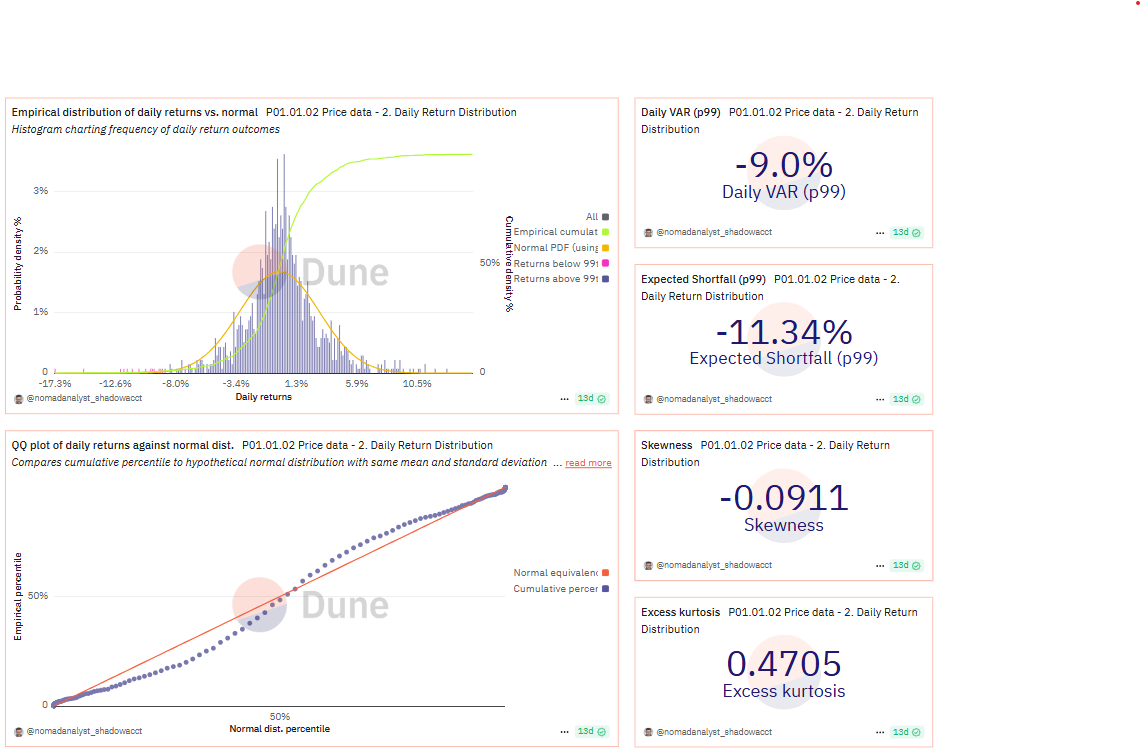

Dune Uniswap v3 Risk Exploration

- SQL-based Dune dashboard analyzing Uniswap v3 liquidity

- Statistical analysis of returns distribution and VAR

- Charts historical price impact levels and dollar liquidity depth

- Charts liquidity distribution and concentration (HHI)

Developed in TradFi... Deployed to Web3

I have worked with dozens of blockchain teams since 2020 — from pre-launch founders to live-token ventures. A journey that began helping startups to raise with token sales has grown into a broader practice in token economics, modeling, and analytics.

At the core of my approach: sound financial thinking, a strong grasp of risk, and a commitment to data-led decisions. These strengths were shaped by working on $400M+ corporate finance deals, Big Four model audits, earning the FRM to navigate risk in crypto markets, and delivering cutting-edge analysis for clients at Bloomberg.

Today, I bring this TradFi experience and analytical rigour to my blockchain clients — combining bespoke analysis with clear communication to deliver insight, guide strategic decisions, and create long-term value.

-

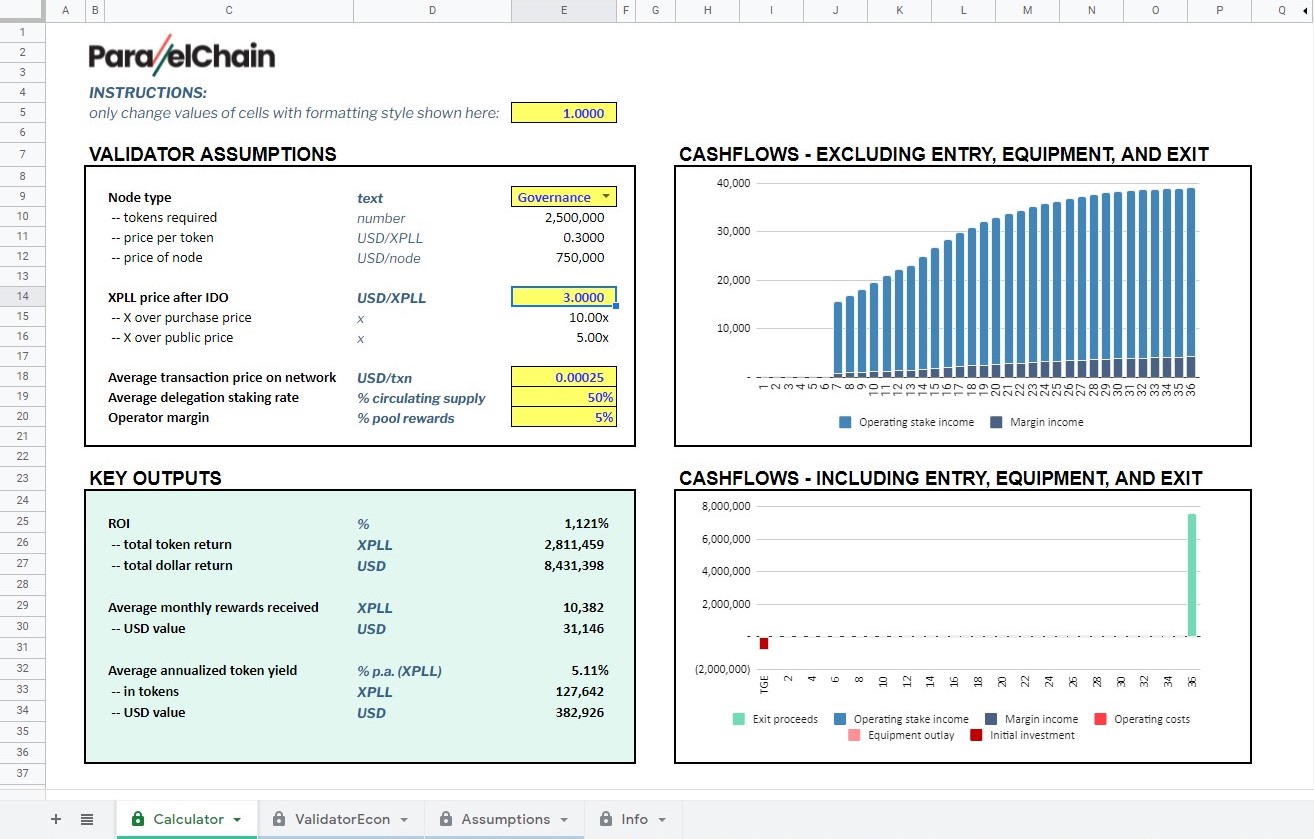

Roderick provided essential deep market research, node validator economics, and tokenomics documentation for a new layer 1 protocol.

He is proactive and a talented communicator who can simply articulate complicated problems and solutions to all levels in a company.

Roderick operates on a whole different level when it comes to tokenomics and is my go to person when I encounter complicated tokenomics questions.

Elliot Hagemeijer CEO Decubate.com

-

Pure professionalism and openness for unconventional solutions.

We jointly developed strategies gave desired head start for the token.

Exceptional sense of the emerging p2e industry made us establish one and only earning mechanism taking advantage of what DeFi has in store.

Michał Szachno CEO MoonieNFT

-

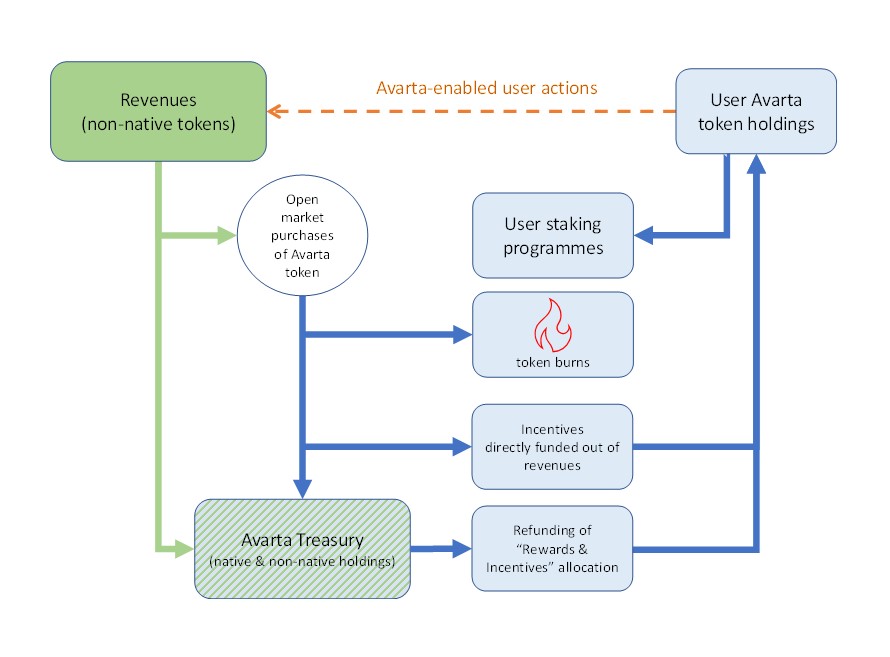

We had the pleasure of working with Roderick on our token utility paper.

Not only was his execution world class he also had an ability to think outside of the box when it came to strategising.

The experience was so productive, we have retained his services to consult on the project an ongoing basis.

Matthew Ainscow CEO Avarta

-

Knowledge, strategic thinking and diligence makes a competent advisor, Roderick has all this and more.

He takes pride in a job well-done and was relentless in his efforts to provide us with a sustainable, growth-driven tokenomics model that befits our identity and long-term vision.

We were particularly pleased and impressed by Roderick’s uncanny ability to distil and communicate complex concepts in an easily digestible and concise manner.

Ian Huang CEO ParallelChain

-

It has been a pleasure having Roderick as our advisor for Kasta.

His experience helped us build tokenomics that really align with the long-term vision we have for our company.

He is very responsive, and there for you when you need his help. I am looking forward to working with him long into the future.

Carl Roegind CEO Kasta

Get In Touch

To Find Out More

Reach Out!

Clients and Partners

over $110m USD raised

Portfolio Samples

ParallelChain_ValidatorDashboard

Proof Of Work – A Portfolio Sample

Dune Dashboard

- Onchain analytics and smart contract decoding

- Real-time performance metrics

Onchain Analytics

and Smart Contract Decoding

- Extract real-time and historical insights from your smart contract interactions

- Build custom Python pipelines to decode and structure blockchain data

- Design tailored metrics and dashboards in Dune or custom frontends

Token Economics

and Financial Modeling

- Design utilities and incentives that align with stakeholders and financial goals

- Leverage your real-world operations data for richer analysis and forecasting

- Simulate future financial outcomes with flexible, readable, assumption-driven models

Data-Led Risk Insights

and Scenario Analysis

- Apply data-driven methods to surface financial and operational risk signals

- Use scenario modeling to explore edge cases and build for resilience

- Bring a structured, FRM-informed approach to risk analysis in tokenized systems